USDT Investment Diversification: Creating Balance in a Stablecoin Portfolio

In an increasingly complex digital asset landscape, USDT investment diversification has become a key strategy for investors who prioritize stability while seeking consistent returns. Rather than relying on a single channel, diversification allows USDT holders to spread capital efficiently and manage risk with greater precision.

The Role of Diversification in USDT Investing

Although USDT is designed to maintain a stable value, diversification remains essential. Different platforms, products, and time horizons carry varying levels of operational and liquidity risk. A thoughtful USDT investment diversification approach helps reduce dependency on any single source of yield.

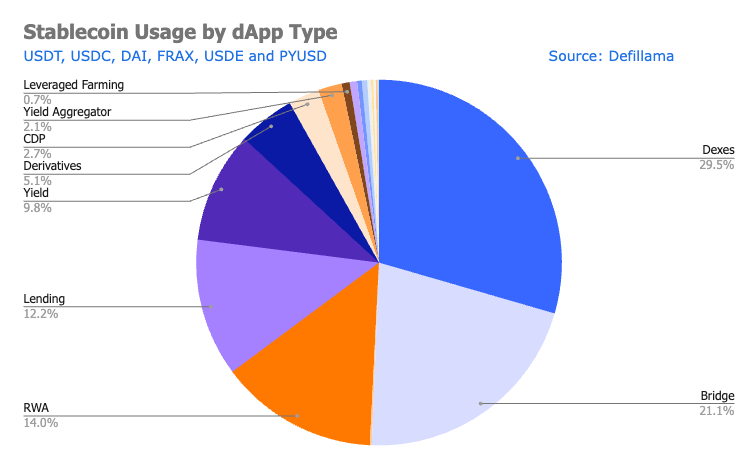

Diversifying Across Investment Structures

USDT can be allocated into multiple structures such as flexible savings, fixed-term products, and liquidity-based strategies. By combining these options, investors create a layered portfolio that balances accessibility and income potential.

Managing Risk Through Allocation Balance

One of the core benefits of diversification is risk control. If one investment channel experiences reduced performance or temporary restrictions, other allocations can help stabilize overall results. This balance is central to sustainable USDT investing.

Enhancing Liquidity and Flexibility

Diversification also improves liquidity management. Maintaining a portion of USDT in easily accessible formats ensures readiness for unexpected needs, while longer-term allocations focus on yield optimization.

Supporting Long-Term Portfolio Growth

Over time, USDT investment diversification supports adaptability. As market conditions and personal goals evolve, diversified portfolios are easier to rebalance without significant disruption, preserving capital while improving efficiency.

Conclusion

USDT investment diversification transforms stablecoin holdings into a resilient financial framework. By spreading USDT across multiple strategies and timeframes, investors can achieve greater stability, flexibility, and confidence in their digital asset portfolios.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...