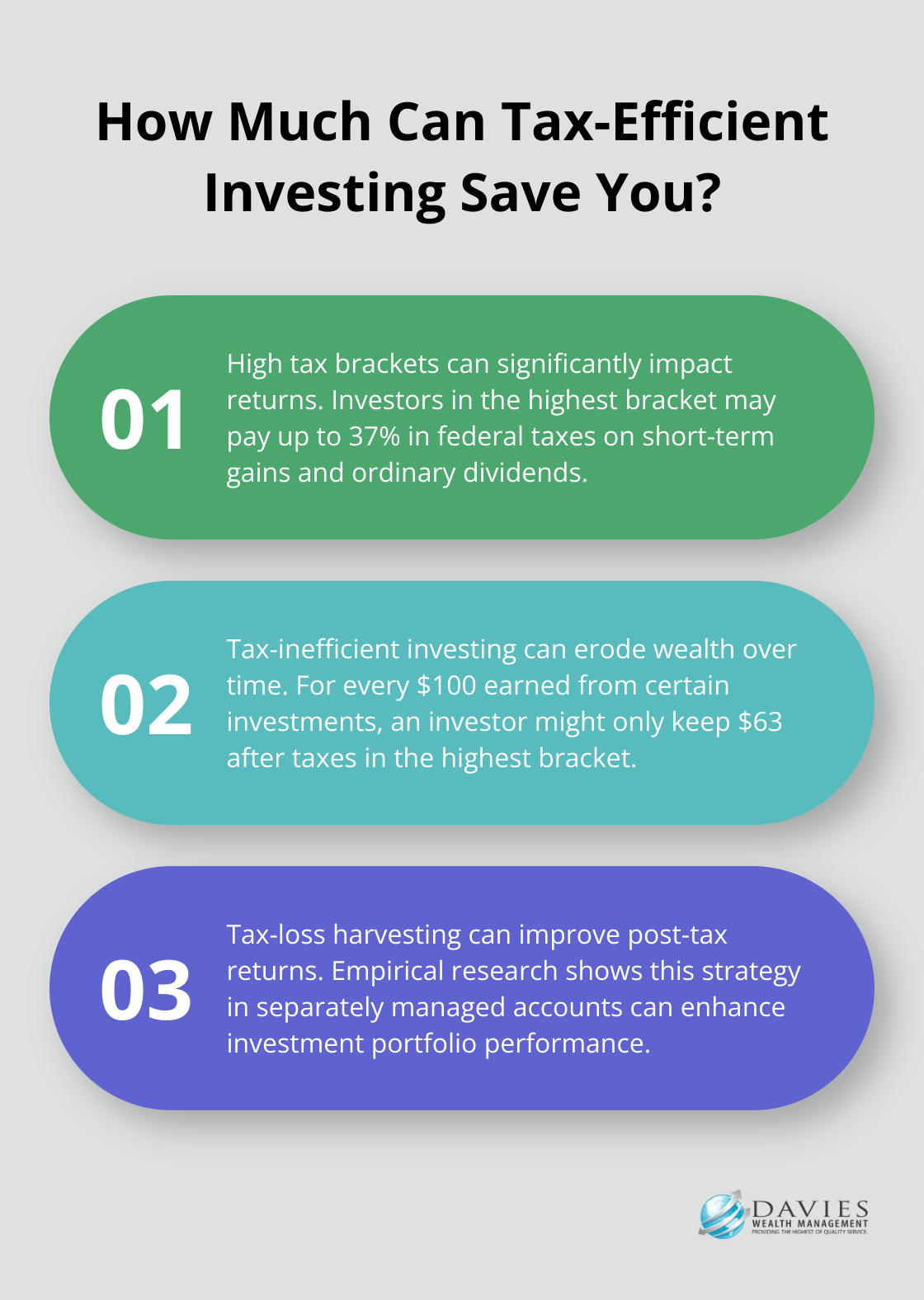

USDT Tax-Efficient Investing: Optimizing Returns Through Smarter Structure

As digital assets become part of long-term financial planning, taxation plays an increasingly important role in overall performance. USDT tax-efficient investing focuses on structuring stablecoin strategies in ways that improve net returns while maintaining compliance and clarity.

Understanding Tax Efficiency in USDT Strategies

Tax efficiency is about minimizing unnecessary tax impact without increasing risk. In the context of USDT, this often involves understanding how interest income, transfers, and reinvestment activities are treated within different jurisdictions.

Why USDT Supports Tax-Efficient Planning

Because USDT does not rely on price appreciation, investors can focus on income generation and capital management. This clarity simplifies record-keeping and makes USDT tax-efficient investing easier to integrate into broader financial plans.

Structuring Income and Reinvestment Wisely

How and when income is realized can affect tax outcomes. Spreading income sources, timing withdrawals, and reinvesting earnings thoughtfully may help smooth taxable events and improve after-tax efficiency over time.

Tracking and Documentation

Accurate tracking is essential for tax efficiency. Monitoring interest earned, transaction history, and holding periods allows investors to maintain transparency and prepare for reporting obligations with confidence.

Long-Term Planning and Professional Guidance

Tax rules vary widely and change over time. Reviewing strategies regularly and aligning USDT activity with long-term goals supports sustainable, compliant investing. Professional advice can further enhance USDT tax-efficient investing outcomes.

Conclusion

USDT tax-efficient investing combines stability with thoughtful planning. By understanding income structures, tracking activity carefully, and aligning strategies with tax considerations, investors can protect net returns and build more efficient digital asset portfolios.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...