USDT Mining Fees: Understanding the Hidden Costs Behind Stablecoin Earnings

When evaluating any earning model, returns often get the spotlight—but costs quietly shape the final outcome. USDT mining fees play a critical role in determining net results within stablecoin-based mining-style systems. Knowing how these fees work helps users assess efficiency, transparency, and long-term viability.

What Are USDT Mining Fees?

USDT mining fees refer to the charges associated with participating in USDT-based earning systems. Since there is no hardware or electricity involved, these fees are typically service-related, covering platform operation, automation, reward distribution, or liquidity management.

Common Types of Fees You May Encounter

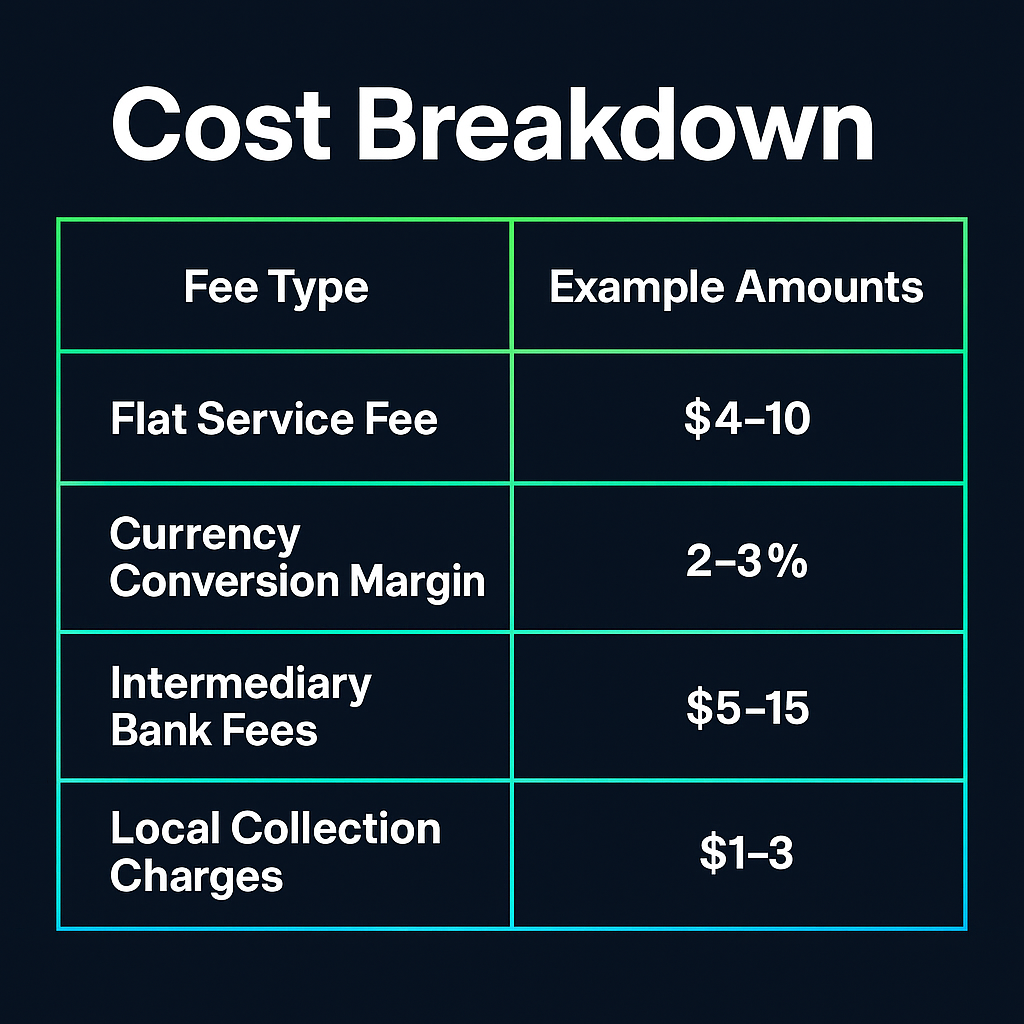

USDT mining fees can appear in several forms, including:

Participation or management fees

Reward distribution or processing fees

Entry or exit fees tied to allocation cycles

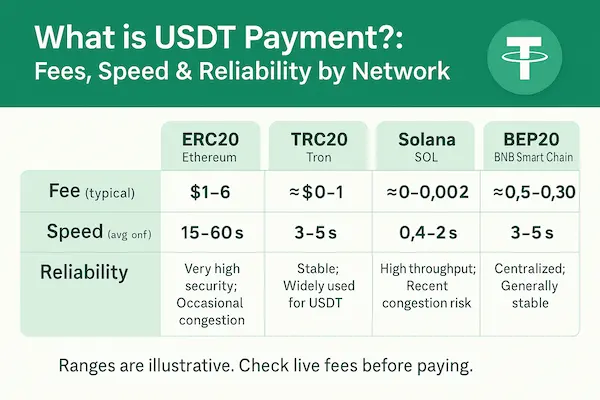

Network transaction fees when moving USDT

Not all fees are charged explicitly; some are embedded into the return structure.

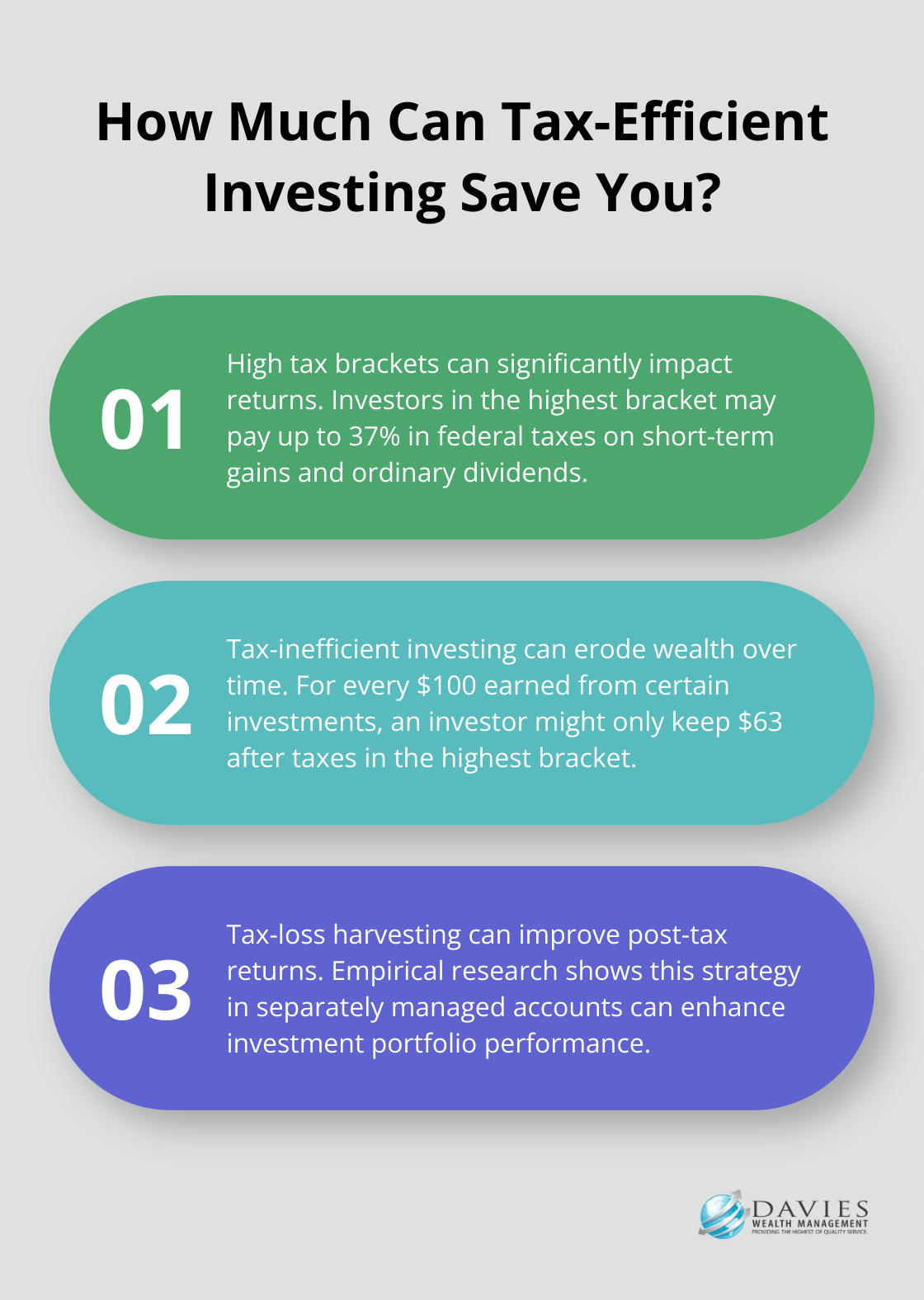

Why Fees Matter More Than They Seem

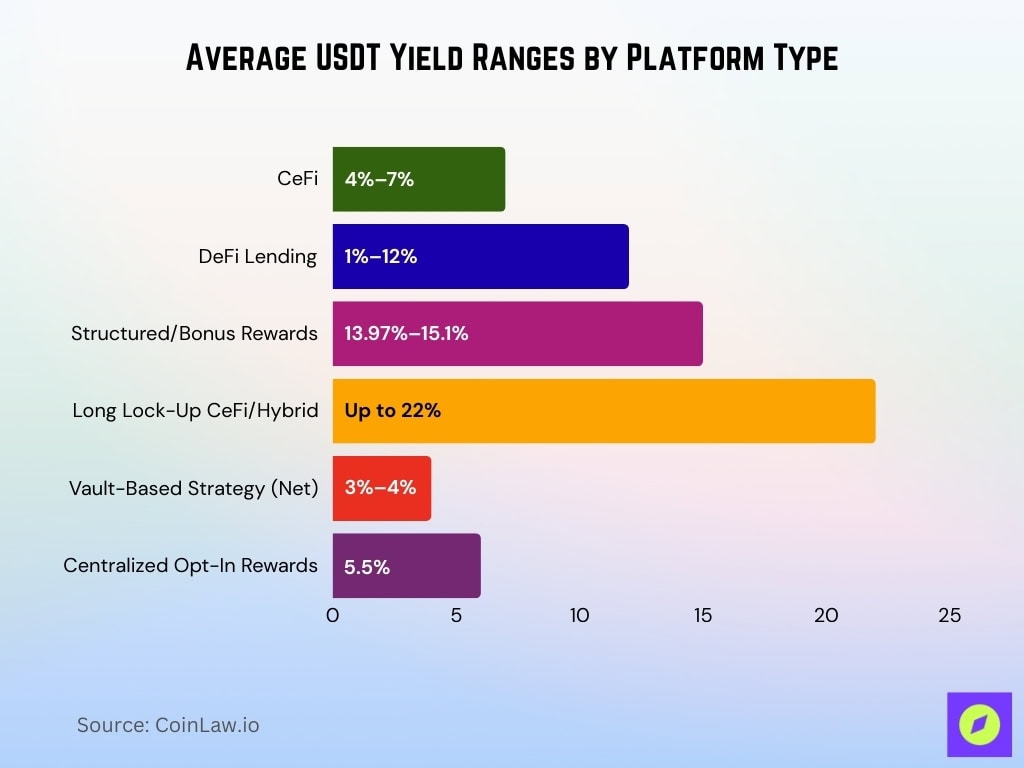

Because USDT mining returns are usually steady rather than explosive, fees have a greater relative impact on net income. Even small percentage differences can significantly affect long-term outcomes, especially in systems designed for consistency over time.

Transparency vs. Hidden Costs

Reliable systems clearly explain how USDT mining fees are calculated and when they apply. A lack of clarity around fees can make advertised returns misleading. Understanding the full fee structure is often more important than focusing on headline yield numbers.

Comparing Fees Across Systems

When comparing different USDT mining options, users should look beyond surface-level returns and examine:

Total fees over the participation period

How fees scale with allocation size

Whether fees reduce flexibility or liquidity

This comparison helps identify which systems are truly efficient rather than just attractive on paper.

Fees as a Signal of System Design

Reasonable USDT mining fees often reflect sustainable system operation, covering automation, security, and maintenance. Extremely low or unclear fees may raise questions about long-term reliability, while excessive fees can erode the value of stable returns.

Conclusion

USDT mining fees are a fundamental part of stablecoin-based earning models. By understanding where fees come from and how they affect net results, users can make more informed decisions and avoid unpleasant surprises. In structured earning systems, cost awareness is just as important as return expectations.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...