USDT Mining ROI: Interpreting Returns in Stablecoin Earning Models

When evaluating stablecoin-based earning systems, numbers alone rarely tell the full story. USDT mining ROI—return on investment—helps users understand how effectively allocated USDT generates outcomes over time. Interpreting ROI correctly is essential for realistic expectations and disciplined planning.

What Does USDT Mining ROI Mean?

USDT mining ROI measures the relationship between allocated USDT and the net results produced by a mining-style earning system. Because USDT maintains a stable value, ROI in this context focuses on system efficiency rather than price appreciation.

ROI vs. Absolute Earnings

A large payout does not always indicate strong ROI. ROI considers proportional performance, making it easier to compare different participation sizes and durations. This perspective helps users evaluate efficiency instead of being influenced by raw totals.

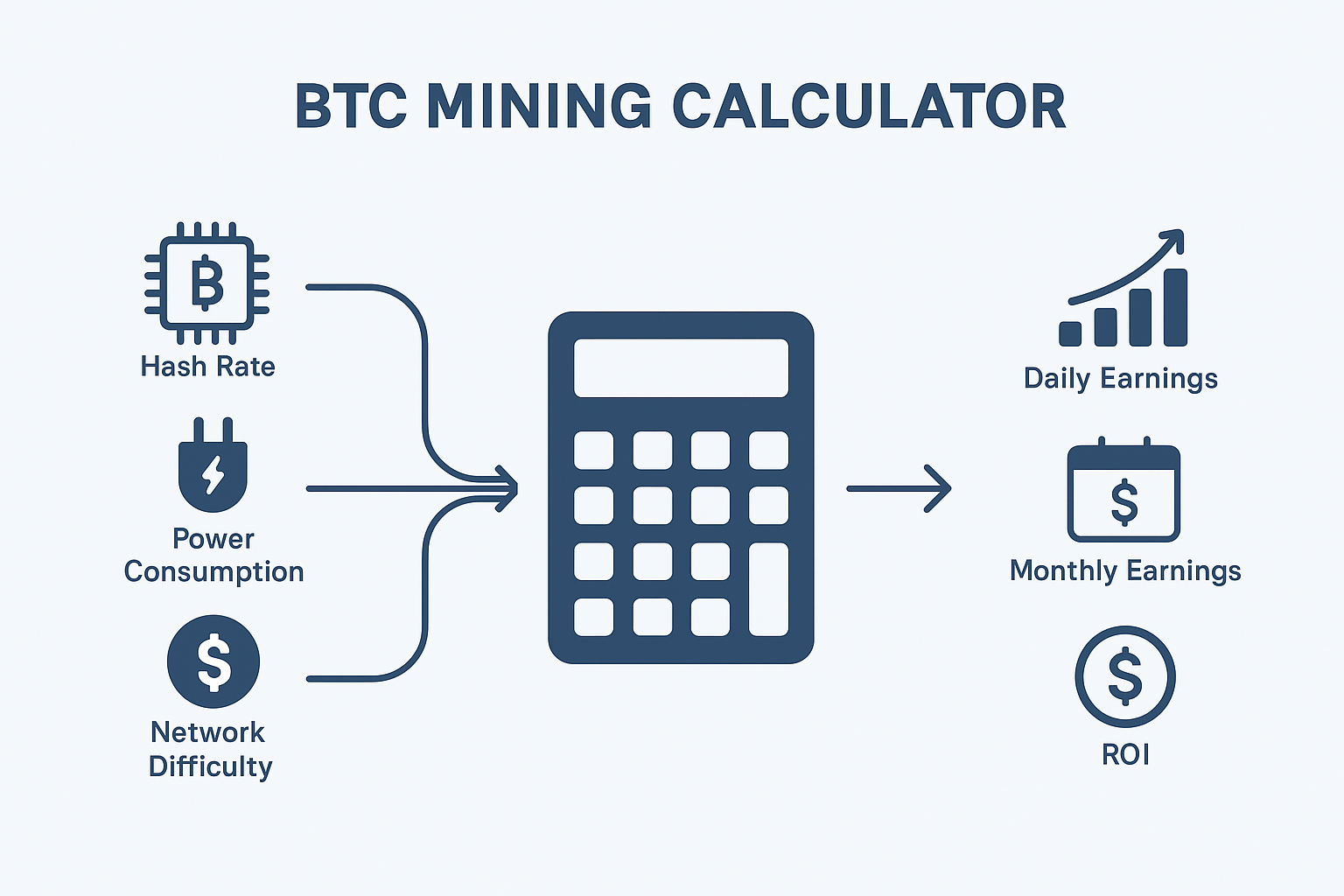

How ROI Is Typically Calculated

USDT mining ROI is usually calculated by comparing:

Initial USDT allocation

Total earnings over a defined period

Net results after fees and costs

Clear time frames are essential, as ROI changes depending on duration.

Time Horizon and ROI Interpretation

Short-term ROI may look attractive but can be misleading if it does not scale consistently. Long-term ROI highlights sustainability and helps users assess whether results are repeatable rather than exceptional.

Factors That Influence ROI

Several elements affect USDT mining ROI:

Allocation size and timing

Distribution frequency

Transaction and platform costs

Reinvestment or compounding options

Evaluating ROI requires considering these factors together, not in isolation.

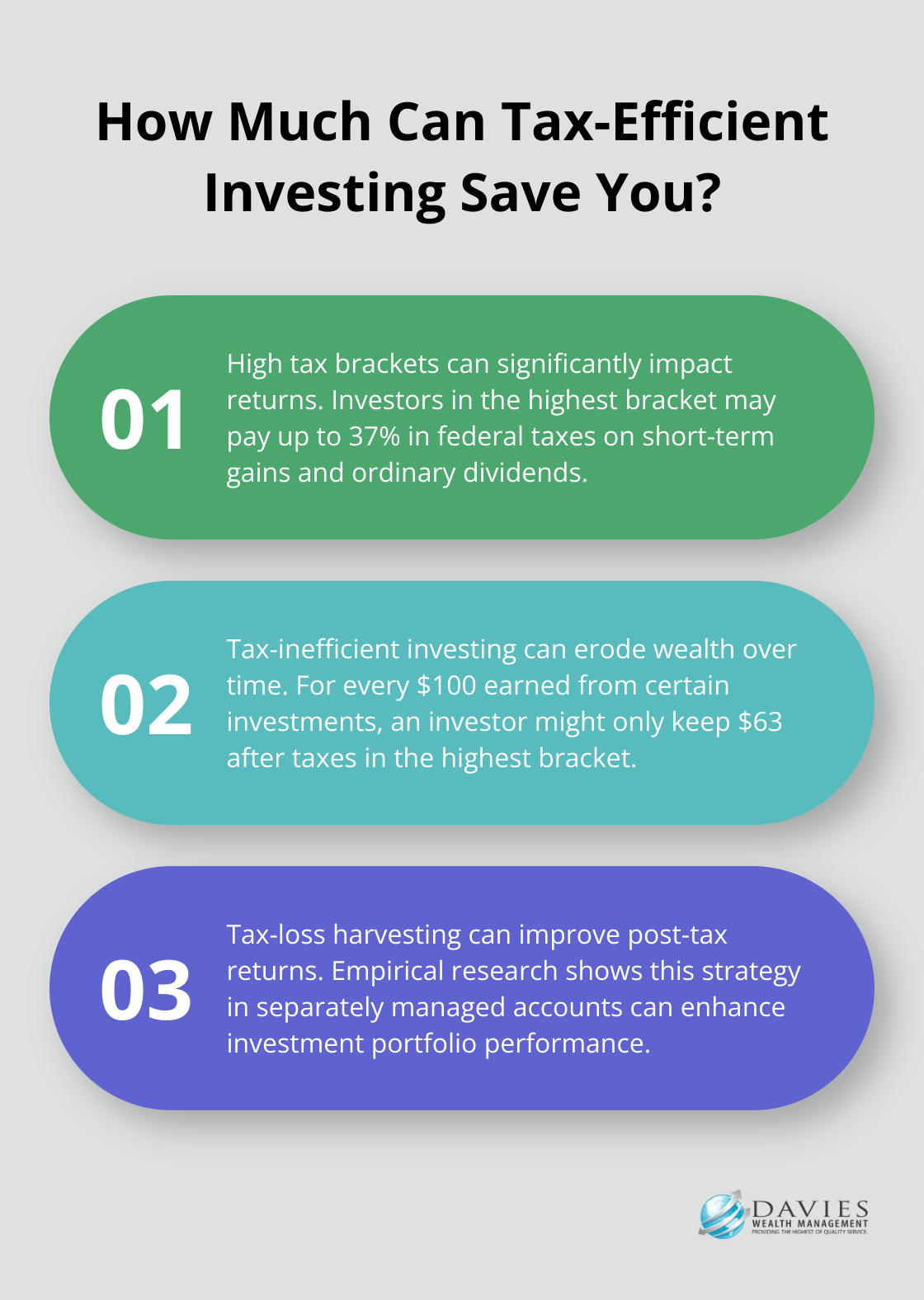

ROI and Risk Awareness

Even in stablecoin models, ROI should be evaluated alongside risk. Higher projected ROI may involve stricter conditions, reduced liquidity, or longer commitment periods. Balanced evaluation looks at both efficiency and constraints.

Using ROI as a Decision Tool

ROI is most useful when used for comparison and planning, not prediction. It helps users decide where capital is allocated and whether a system aligns with personal goals, rather than promising specific outcomes.

Conclusion

USDT mining ROI provides a structured way to evaluate performance in stablecoin earning systems. By focusing on proportional returns, time frames, and net outcomes, users gain a clearer understanding of system efficiency. In structured earning models, informed ROI analysis supports smarter, more confident participation.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...