TRX Automated Portfolio: Simplifying Crypto Investments on the TRON Blockchain

Managing a diversified portfolio can be complex, especially in the fast-paced crypto ecosystem. TRX automated portfolio solutions allow investors to leverage TRON-based tools and smart contracts to optimize allocation, minimize manual effort, and maintain balanced exposure across assets.

What Is a TRX Automated Portfolio?

A TRX automated portfolio is a pre-programmed investment system that allocates TRX and TRON-based tokens across multiple financial products, such as staking, lending, and liquidity pools. Using automation, portfolios can rebalance, reinvest rewards, and adjust allocations based on predefined strategies without constant user intervention.

Key Benefits of TRX Automated Portfolios

Time Efficiency

Automation reduces manual tracking, trading, and reallocation tasks, freeing investors to focus on strategy and planning.Consistent Rebalancing

The portfolio automatically adjusts allocations to maintain target risk and reward profiles, ensuring consistent exposure.Compounding Rewards

Automated reinvestment of staking or lending rewards accelerates portfolio growth through compounding.Reduced Emotional Bias

Automation removes impulsive decision-making caused by market fluctuations, helping investors stick to long-term strategies.Transparency and Security

Platforms typically use smart contracts on the TRON blockchain, ensuring predictable execution, auditability, and reduced counterparty risk.

How TRX Automated Portfolios Work

Define Goals

Investors set objectives, such as target returns, risk tolerance, or liquidity requirements.Select Assets

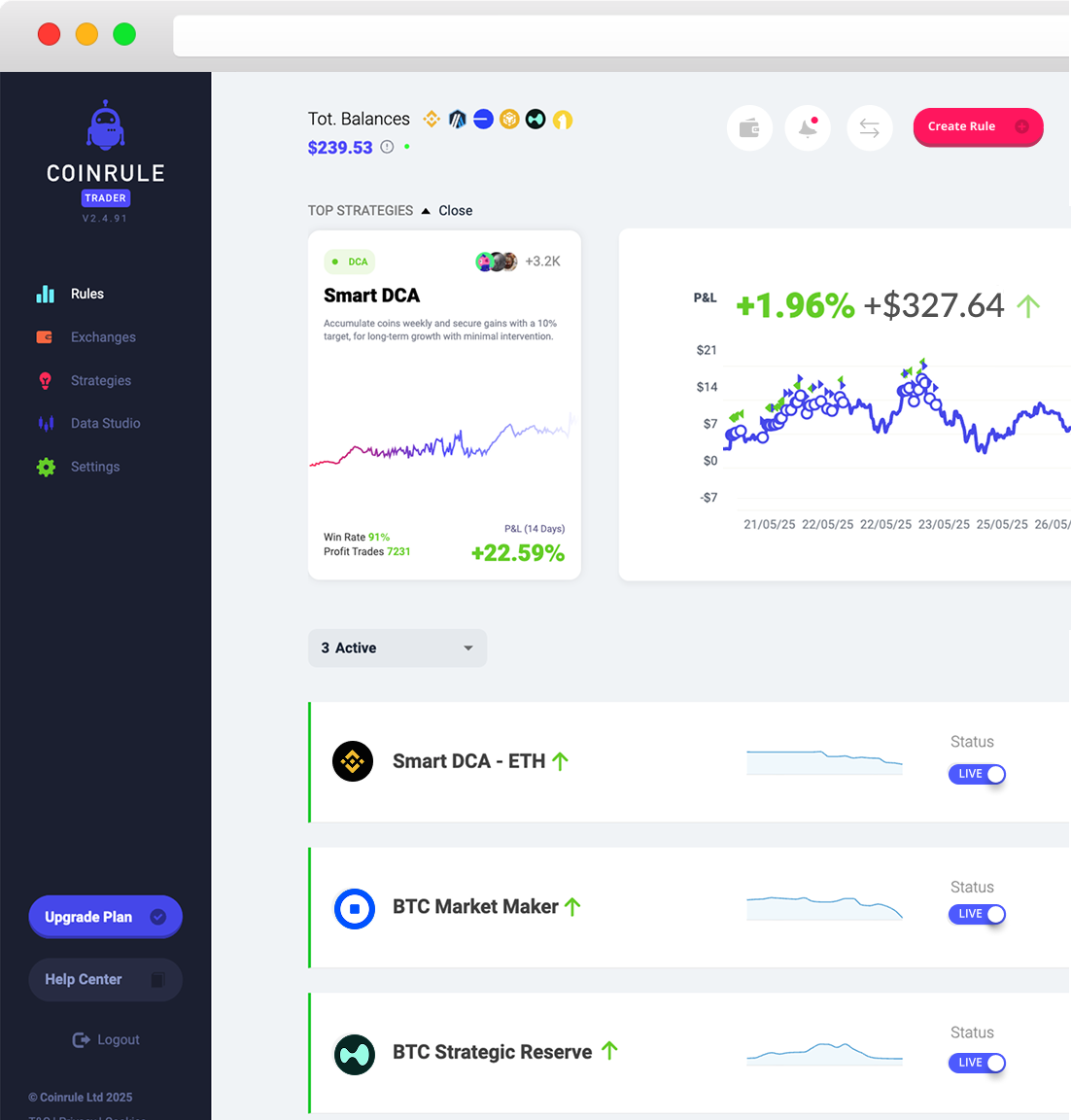

The system allocates TRX and other TRON-based tokens according to diversification rules.Set Automation Rules

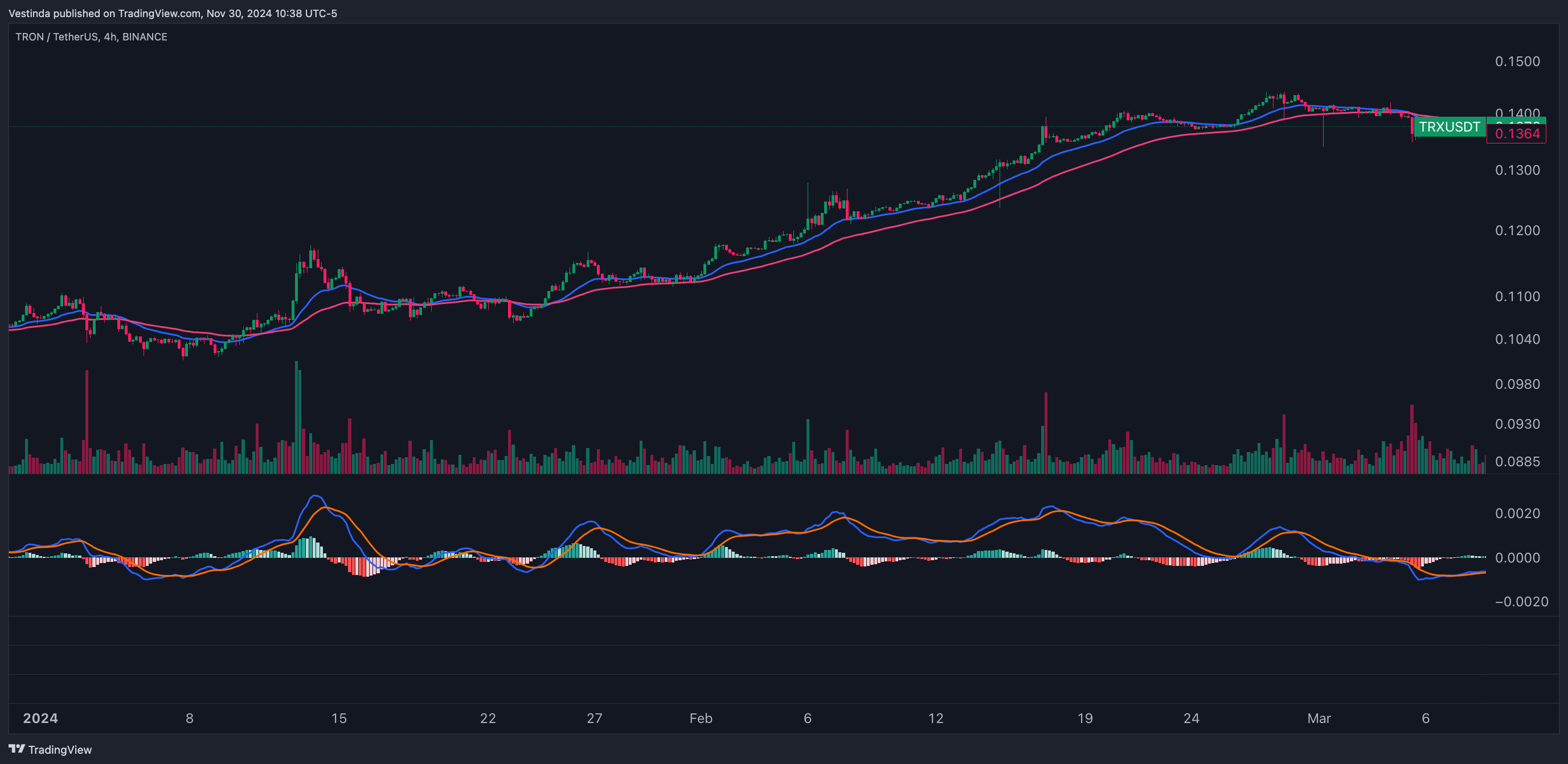

Rebalancing frequency, reinvestment schedules, and risk thresholds are defined.Monitor Performance

Dashboards track growth, allocation changes, and rewards earned, providing insight into portfolio health.

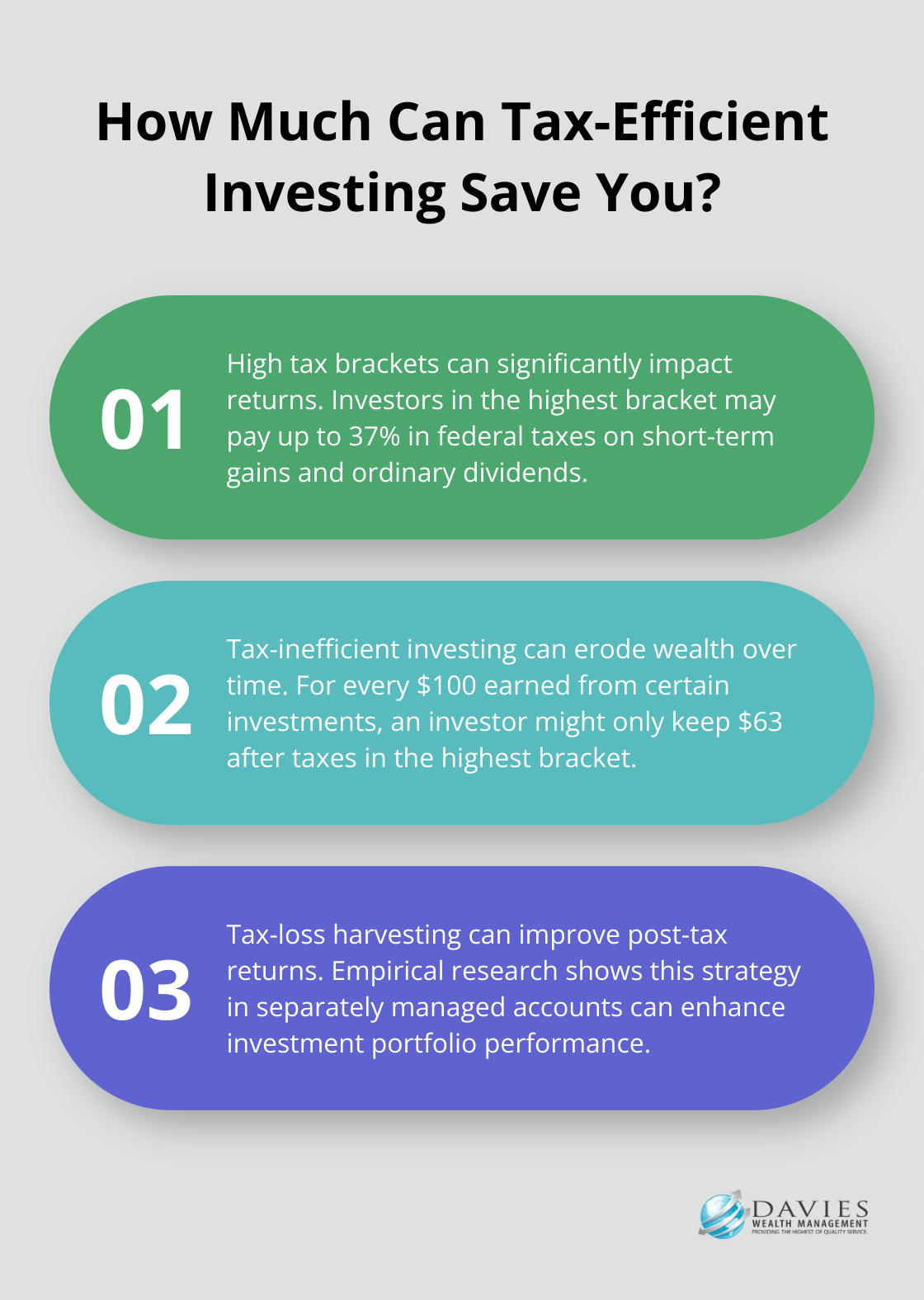

Considerations for Investors

Ensure the platform is secure and has audited smart contracts

Review fee structures associated with automated management

Understand liquidity and withdrawal rules before allocating funds

Monitor portfolio performance periodically to adjust long-term goals

Conclusion

A TRX automated portfolio offers a powerful way to simplify TRON-based investments while optimizing growth and reducing manual effort. By combining automation, strategic allocation, and transparent execution, investors can efficiently manage risk, capture rewards, and maintain a balanced approach to crypto wealth building.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...