USDT Financial Product Review: Evaluating Stablecoin Investment Opportunities

As the stablecoin market grows, investors have access to a variety of USDT financial products. Conducting a USDT financial product review is essential for selecting platforms that balance yield, security, and accessibility in the evolving DeFi ecosystem.

What Are USDT Financial Products?

USDT financial products are investment tools and services built around the Tether stablecoin. They include:

Staking Programs: Earn interest by locking USDT on trusted platforms.

Lending Platforms: Lend USDT to borrowers and earn returns.

Liquidity Pools: Provide USDT to decentralized exchanges and earn transaction fees.

Yield Optimization Protocols: Use automated strategies to maximize returns on USDT holdings.

Criteria for a Comprehensive USDT Financial Product Review

Security and Platform Reliability

Ensure smart contracts are audited.

Prefer platforms with strong track records and transparent operations.

Interest Rates and Rewards

Compare APYs across products to determine potential returns.

Consider compounding frequency and distribution methods.

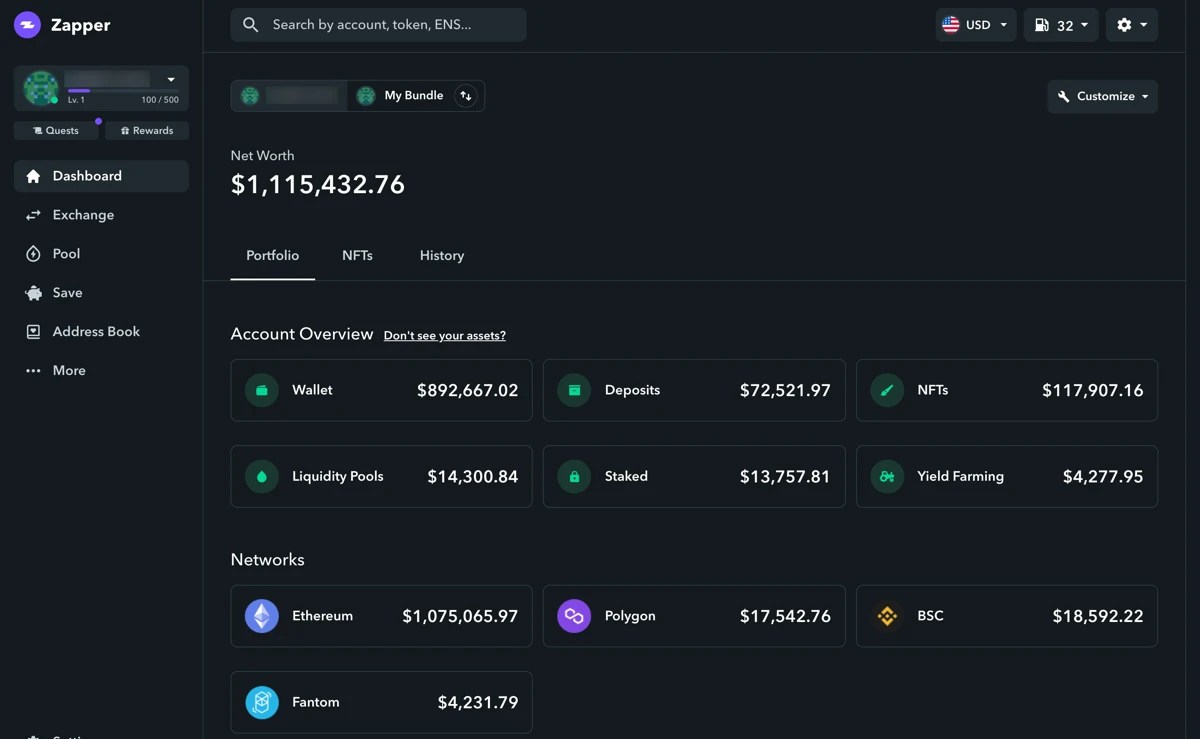

Liquidity and Accessibility

Review lock-up periods, withdrawal limits, and flexibility of accessing funds.

Fees and Costs

Evaluate trading, deposit, withdrawal, and performance fees that may reduce net returns.

User Experience and Support

Consider dashboard usability, customer support, and educational resources.

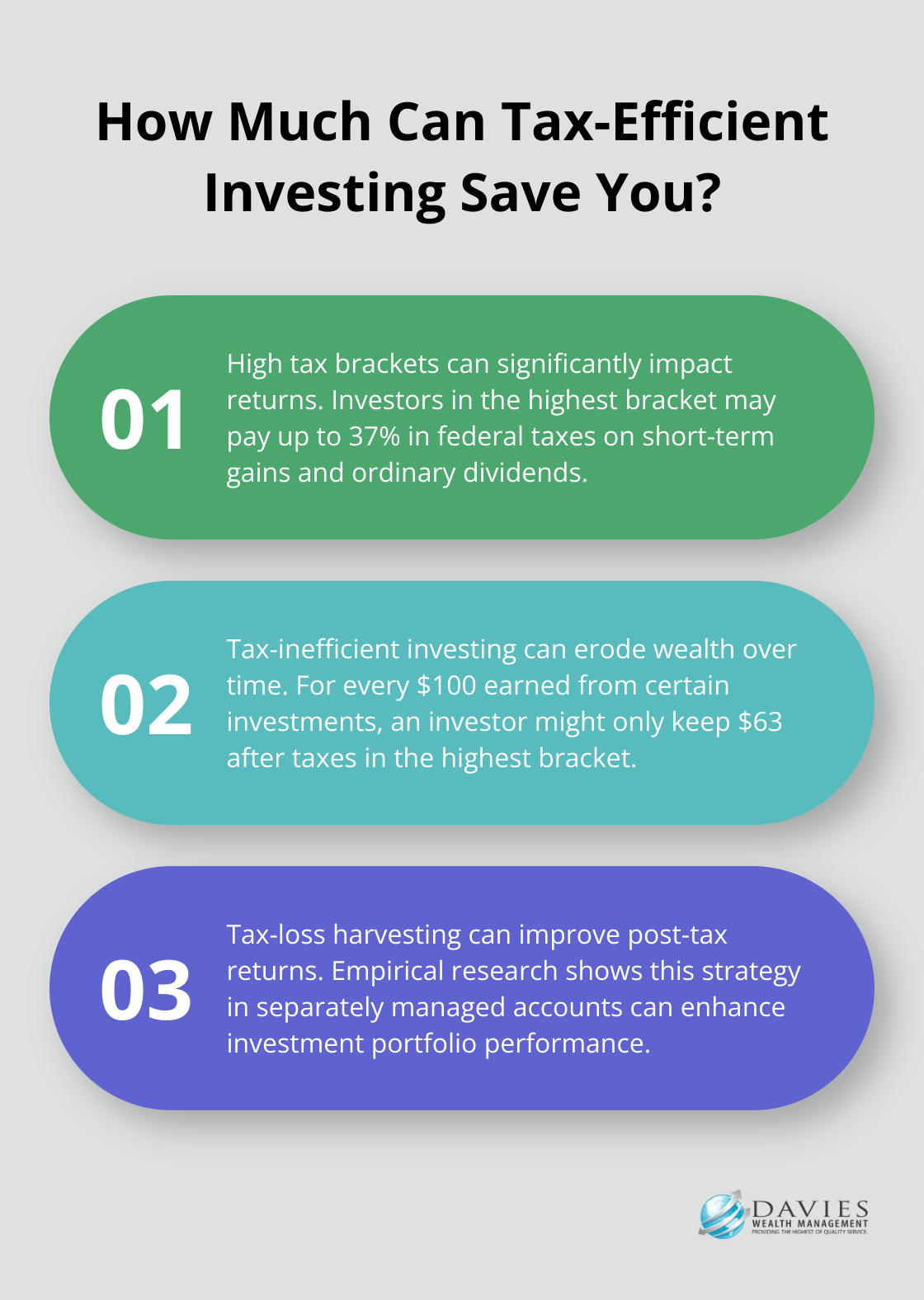

Benefits of Using USDT Financial Products

Stable Income Streams: USDT’s pegged value ensures predictable returns.

Diversification: Combine multiple products to spread risk and enhance yield.

Low Volatility Exposure: Minimize crypto market fluctuations while earning interest.

Flexibility: Many products allow reinvestment or quick portfolio adjustments.

Considerations and Risks

Platform vulnerabilities or smart contract errors

Market and liquidity fluctuations affecting yields

Regulatory changes impacting DeFi and stablecoin usage

Fee structures reducing effective returns

Conclusion

Conducting a USDT financial product review is critical for building a secure, profitable, and flexible stablecoin portfolio. By evaluating security, rewards, liquidity, and fees, investors can identify the best platforms to maximize USDT returns while minimizing risk in the DeFi ecosystem.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...