USDT Automated Portfolio: Streamlining Stablecoin Investments

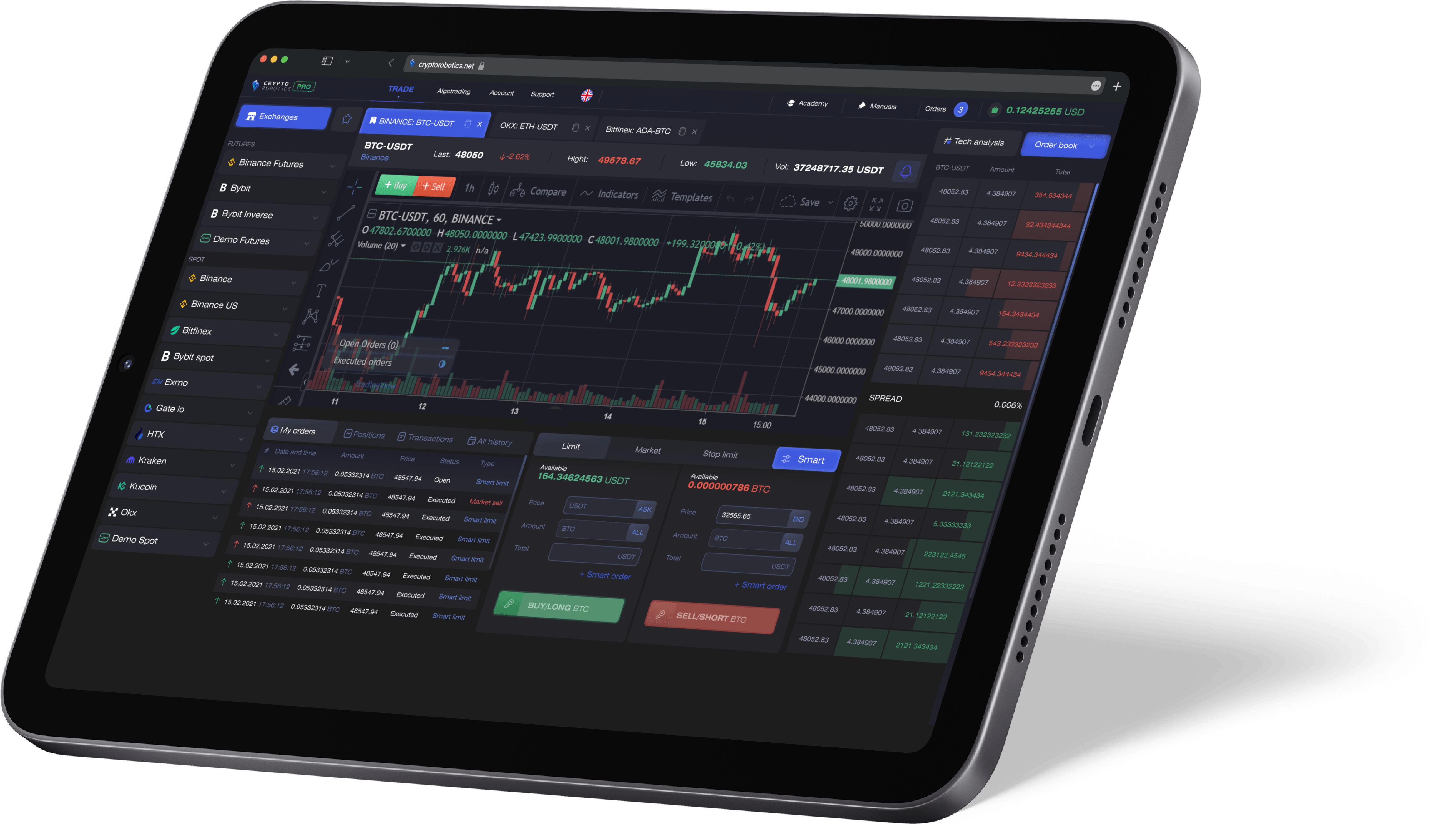

Managing a diversified crypto portfolio can be time-consuming. A USDT automated portfolio allows investors to leverage technology to allocate, monitor, and optimize their stablecoin holdings without constant manual intervention.

What Is a USDT Automated Portfolio?

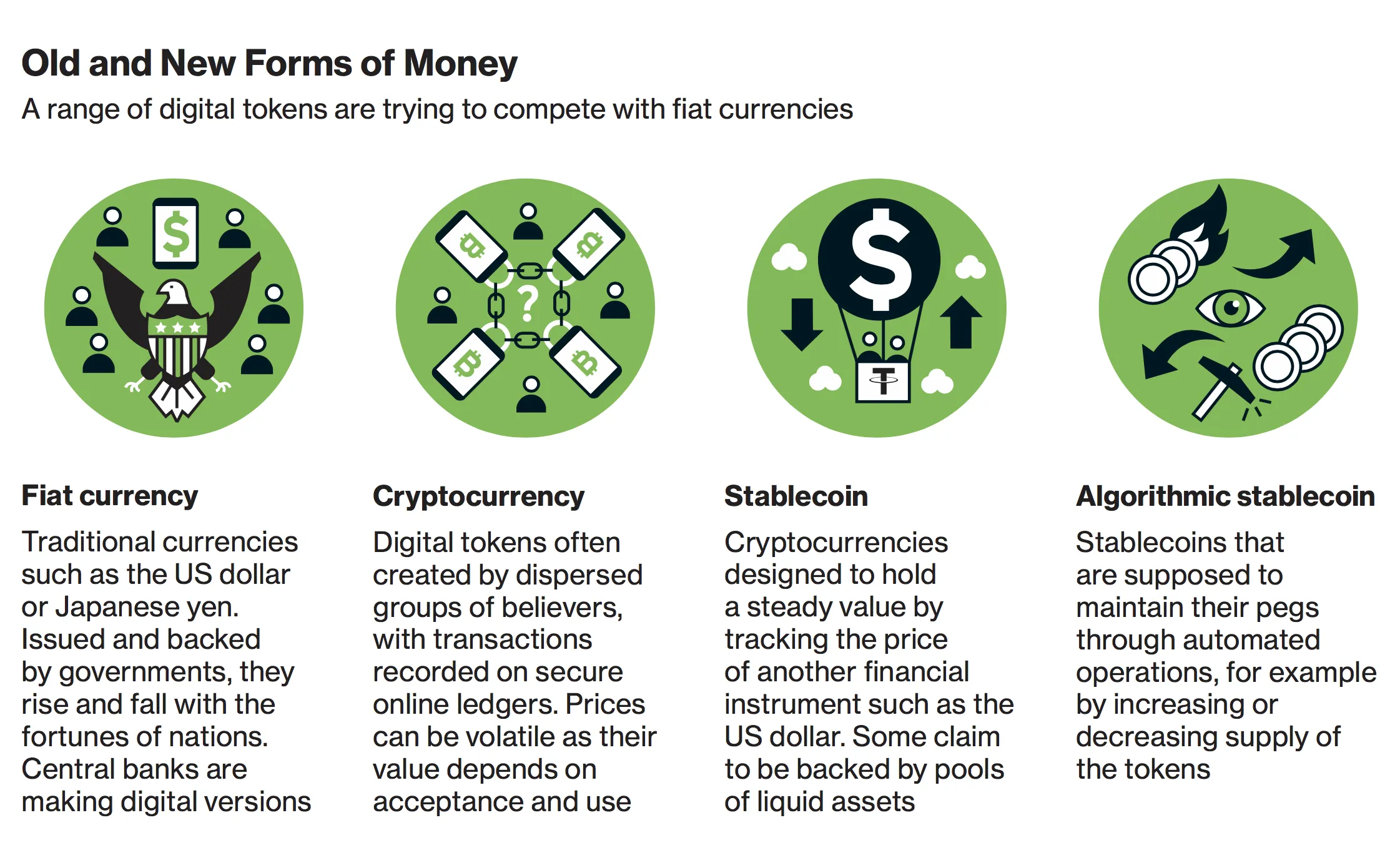

A USDT automated portfolio is a digital investment system that uses algorithms and smart contracts to manage USDT holdings. The portfolio can automatically distribute assets across staking, lending, liquidity pools, and yield optimization strategies to maintain target allocations and maximize returns.

Benefits of Using an Automated USDT Portfolio

Time Efficiency

Automates routine allocation, reinvestment, and reward collection, reducing manual effort.

Optimized Returns

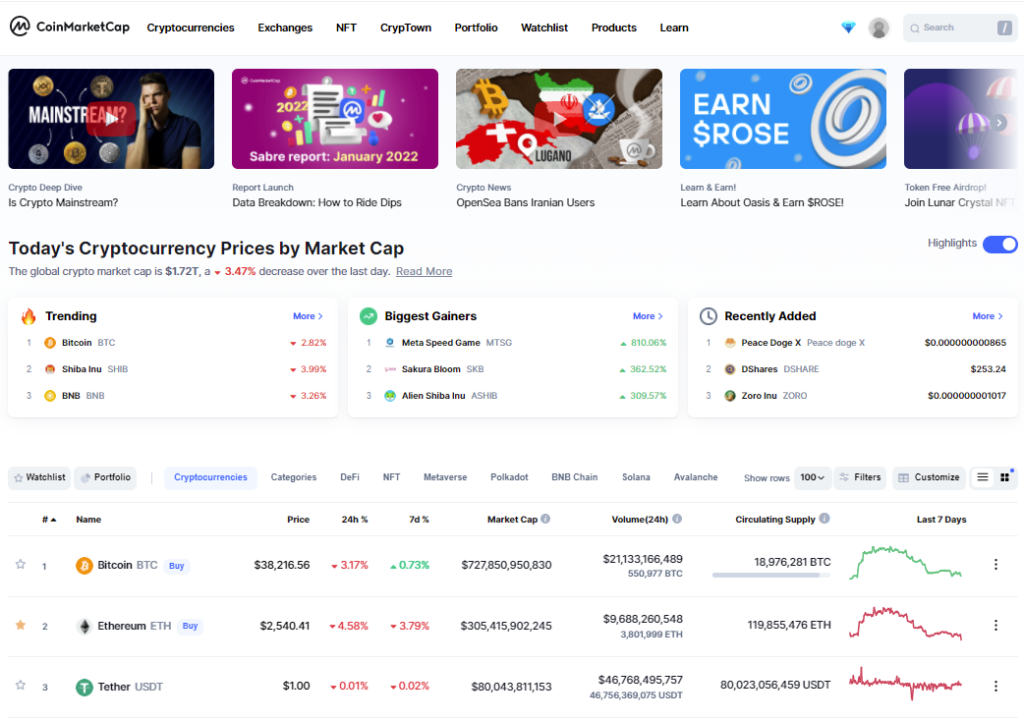

Algorithmic strategies adjust allocations dynamically to capture the best yields across platforms.

Risk Management

Diversifies USDT holdings automatically, minimizing exposure to platform-specific risks.

Consistency

Ensures disciplined reinvestment and allocation, avoiding emotional decision-making.

Transparency

Smart contracts and dashboards provide real-time tracking of allocations, yields, and performance.

Key Strategies Within a USDT Automated Portfolio

Dynamic Rebalancing: Automatically adjust allocations to maintain desired risk/reward ratios.

Yield Optimization: Allocate USDT to the highest-yield opportunities in staking, lending, or liquidity pools.

Multi-Platform Diversification: Spread assets across multiple platforms to reduce counterparty risk.

Compound Interest: Automatically reinvest earned rewards to accelerate portfolio growth.

Considerations and Risks

Reliance on smart contract security and platform reliability

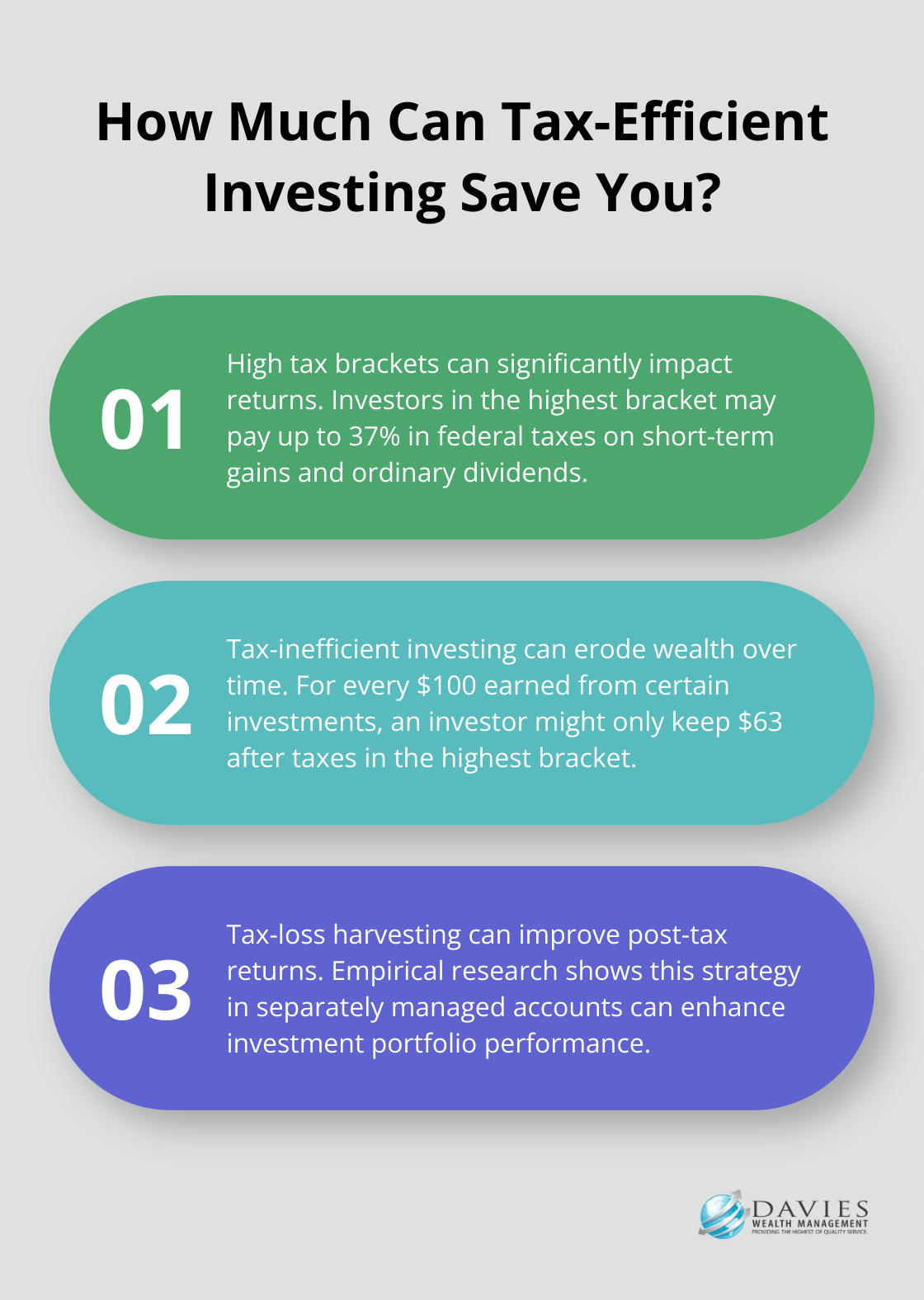

Fees and performance-based charges affecting net returns

Limited customization in some automated platforms

Regulatory and compliance risks for DeFi applications

Conclusion

A USDT automated portfolio offers a convenient and efficient way to grow stablecoin assets while maintaining diversification and risk control. By leveraging automation, investors can maximize yields, reduce manual management, and maintain a disciplined approach to USDT wealth accumulation in the evolving DeFi landscape.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...