USDT Crypto Asset Growth: Strategies for Expanding Stablecoin Holdings

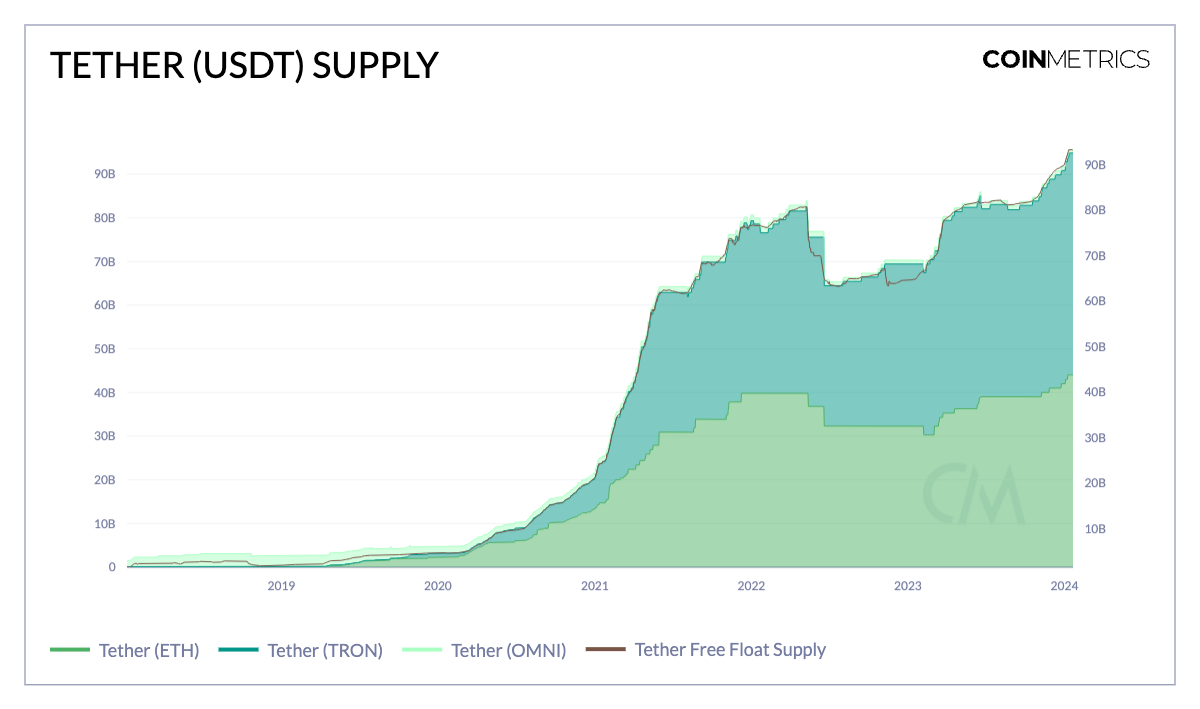

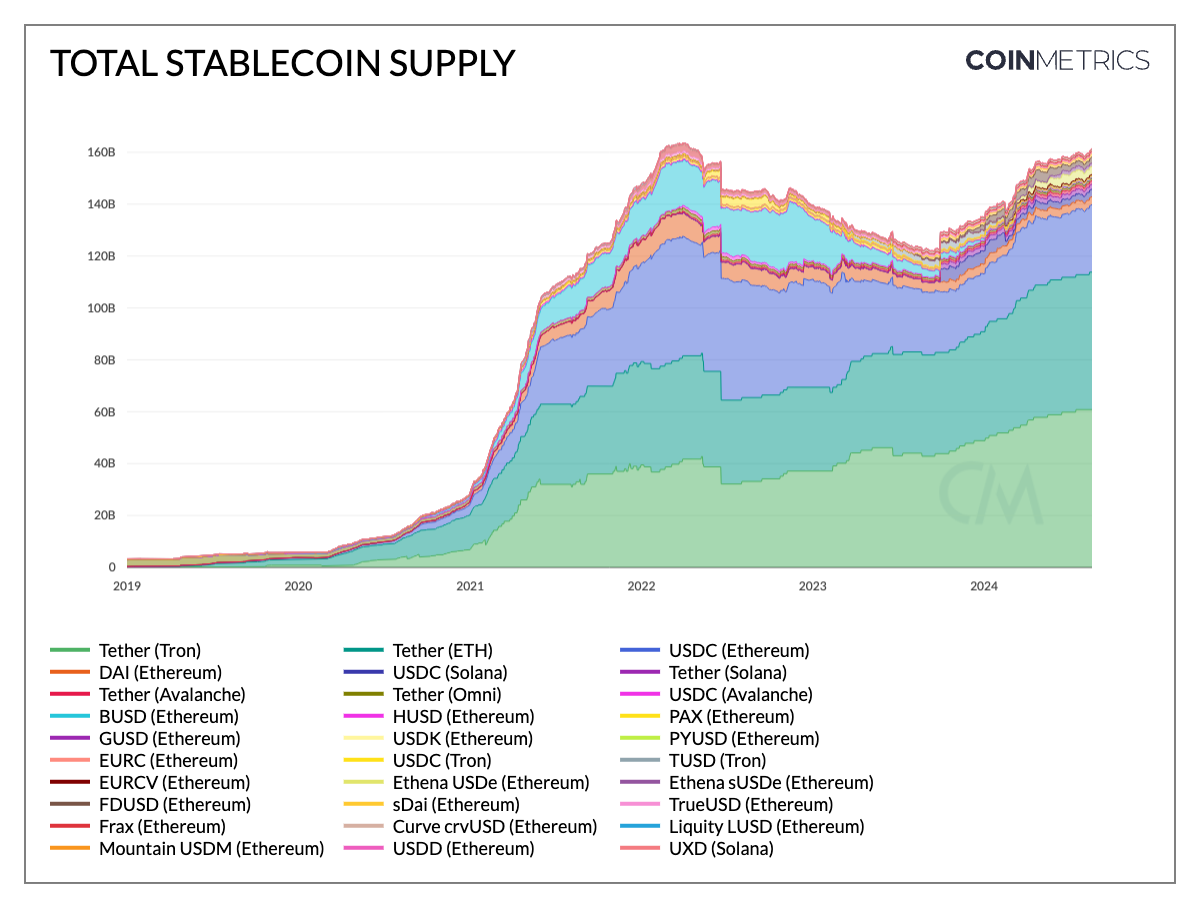

While USDT is a stablecoin pegged to the US dollar, investors can still achieve USDT crypto asset growth by leveraging yield-generating opportunities and smart portfolio management. Growth in this context focuses on increasing holdings through interest, rewards, and strategic allocation rather than price appreciation.

What Is USDT Crypto Asset Growth?

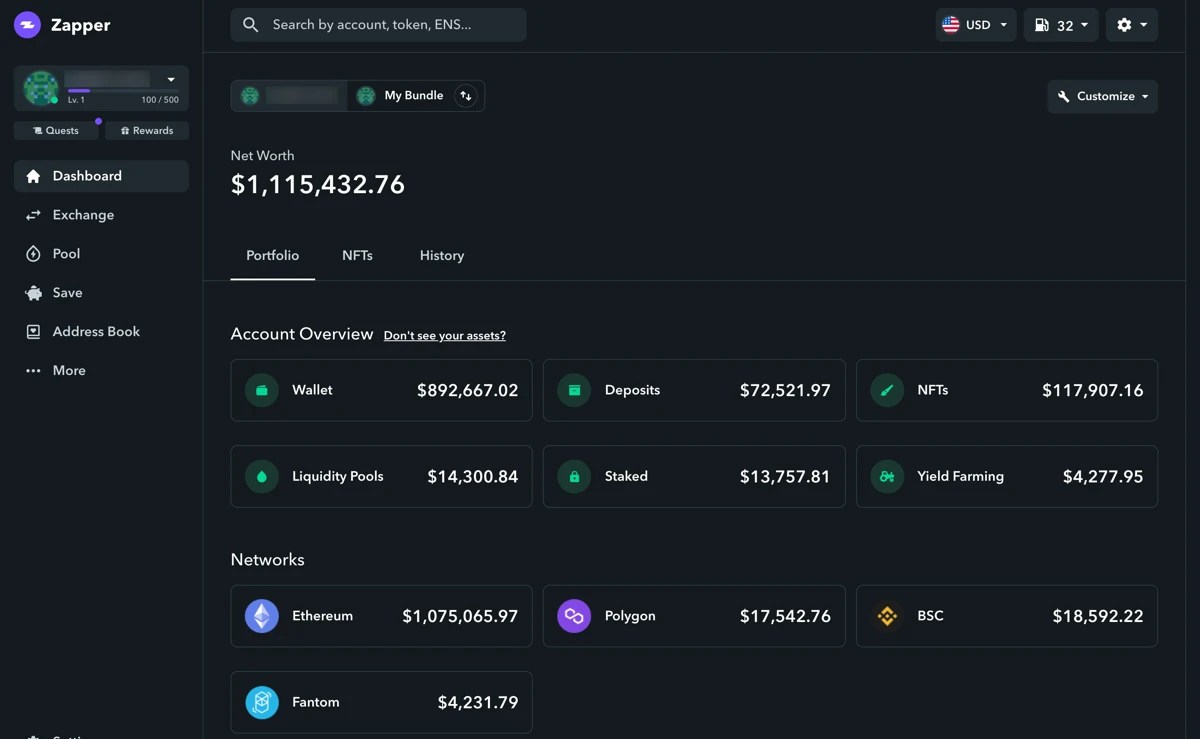

USDT crypto asset growth refers to the expansion of your USDT holdings over time through staking, lending, liquidity provision, and automated yield optimization. Unlike volatile cryptocurrencies, USDT provides stability while generating incremental income.

Key Strategies for USDT Growth

Staking for Rewards

Lock USDT in staking programs to earn interest or network rewards.

Diversify across multiple platforms to reduce platform-specific risk.

Lending Platforms

Lend USDT to borrowers on centralized or decentralized platforms.

Compare interest rates and platform security to maximize net returns.

Liquidity Pool Participation

Contribute USDT to DeFi pools to earn transaction fees in addition to staking rewards.

Monitor pool performance and reward distribution for optimal growth.

Automated Yield Strategies

Use DeFi tools to dynamically allocate USDT to the highest-yield opportunities.

Reinvest earnings to take advantage of compound growth.

Diversification and Risk Management

Combine USDT with other low-volatility assets for a balanced, resilient portfolio.

Maintain some liquidity for flexibility and risk mitigation.

Benefits of Focusing on USDT Growth

Stable, Predictable Income: USDT provides a reliable base for incremental growth.

Low Volatility Exposure: Protects against the swings of traditional cryptocurrencies.

Compounding Opportunities: Reinvested rewards accelerate total asset growth.

Strategic Flexibility: Easily reallocate funds to adapt to changing DeFi opportunities.

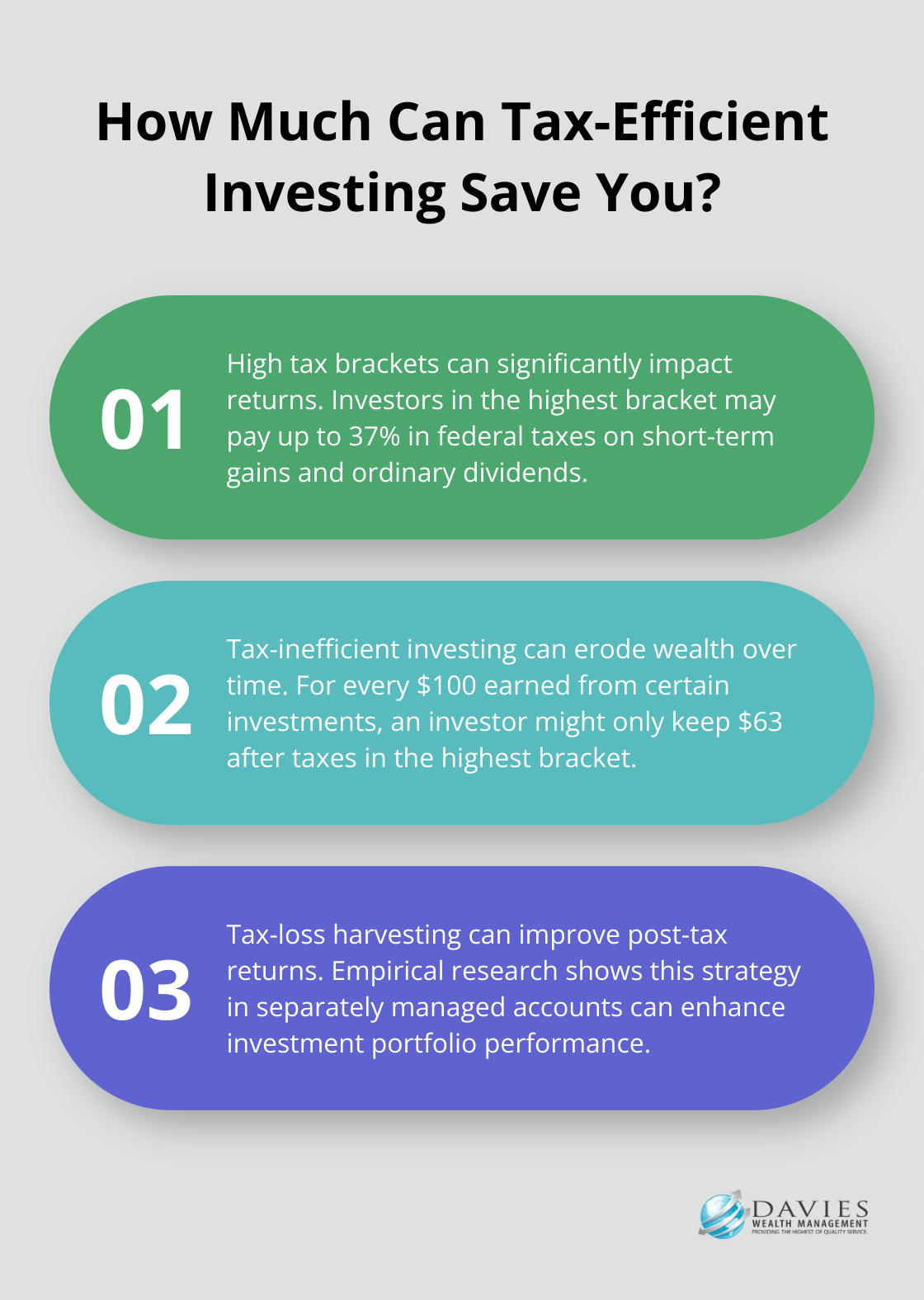

Considerations and Risks

Platform security and smart contract audits

Lock-up periods and withdrawal restrictions

Fee structures affecting net yields

Regulatory compliance for lending or yield programs

Conclusion

USDT crypto asset growth offers a reliable path to expand stablecoin holdings while maintaining security and liquidity. By strategically combining staking, lending, liquidity provision, and automated yield optimization, investors can grow their USDT portfolio steadily and confidently, creating a low-risk foundation for long-term wealth building.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...